Though many people dread it, the time from late January through mid-April known as tax season is a fantastic opportunity to organize (and safeguard) your most important papers.

What documents to keep for your taxes

Not sure what you need to file your taxes? According to the IRS, this tax checklist includes:

Wage and earnings statements. Save documents related to your income, such as W-2 forms from your employers, 1099 forms for contract work, interest and dividends income, Social Security benefits, and unemployment income. A good rule of thumb is that if it’s related to money you earned the previous year, save it.

Documents related to income adjustments. Examples include student loan interest paid statements and closing documentation if you purchased a home in the previous year. These documents are especially important to save because they could bring you a larger refund through the homebuyer tax credit, for example.

Receipts and statements for additional credits and deductions. Save documents related to education and child care costs, medical expenses, charitable donations and moving expenses related to a new job—all of which could earn you tax credits or deductions.

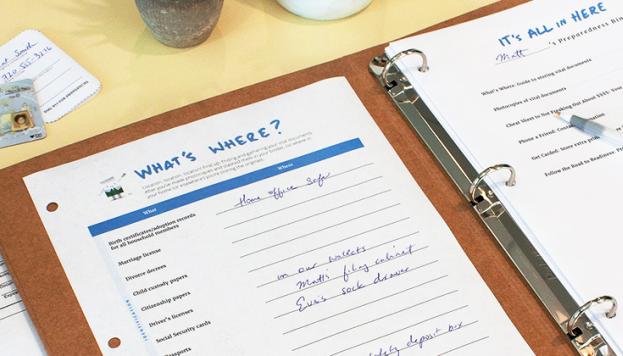

Personal information. Before filing your taxes, you will need to know your Social Security number. If you have a spouse or dependents, you will need their numbers, too.

How long should you keep your documents?

Never throw away your Social Security card. Store it in a fireproof safe or a safe deposit box.

Pay stubs should be shredded after you receive your W-2 and confirm your wages are correct. Similarly, monthly statements related to investment and real estate may be shredded once you receive your annual statement.

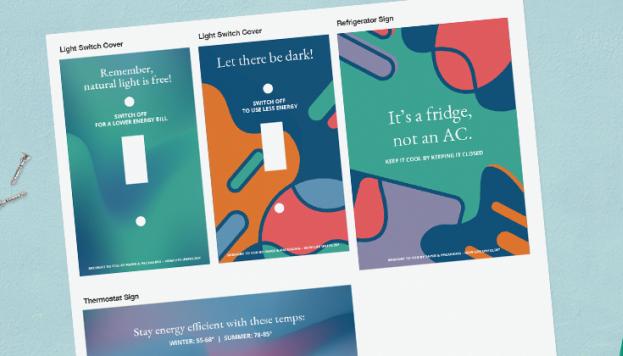

Shredded paper is recyclable. Check your local guidelines to see if it’s accepted in your area.

If so, put the shreds in a paper bag or cardboard box. Staple or tape it shut and recycle it in your curbside recycling bin.

The IRS has three years to audit your tax return. This is also the amount of time filers have to amend their returns. For these reasons, it’s best to save your tax returns, and the documents and forms used to support them, for three years. However, if you claim a loss from a bad debt deduction or from worthless securities for your business, for example, the IRS recommends keeping these records for seven years.

How to discard your documents

While holding onto your documents, keep them secure in a fireproof, locked safe.

After the periods detailed above have passed, ensure that banks, insurance companies and other parties have no further use for your documents. Then shred sensitive papers, such as those that include your Social Security number or medical information. Recycle the rest.